$5 minimum deposit online casino

$5 minimum deposit online casino

This is not the home page, and you've got to click on the left side to get there.

$5 minimum deposit online casino

$5 minimum deposit online casino

$5 minimum deposit online casino

"The people of the United States constitute one nation, under one government, and this government, within the scope of the powers with which it is invested, is supreme. On the other hand, the people of each State compose a State, having its own government, and endowed with all the functions essential to separate and independent existence. The States disunited might continue to exist. Without the States in union there could be no such political body as the United States."

To this we may add that the constitutional equality of the States is essential to the harmonious operation of the scheme upon which the Republic was organized. When that equality disappears we may remain a free people, but the Union will not be the Union of the Constitution." - Coyle v. Smith, 221 US 559 - Supreme Court 1911

$5 minimum deposit online casino

It is clear beyond peradventure that Culhane is substantially behind in paying her mortgage and appears unable to remediate her default. This, however, does not render her an outlaw, subject to having her home seized by whatever bank or loan servicer may first lay claim to it. She still has legal rights. Everything that follows attempts to sort out these competing claims. - Culhane v. Aurora Loan Services of Nebraska, 826 F. Supp. 2d 352 - Dist. Court, D. Massachusetts

$5 minimum deposit online casino

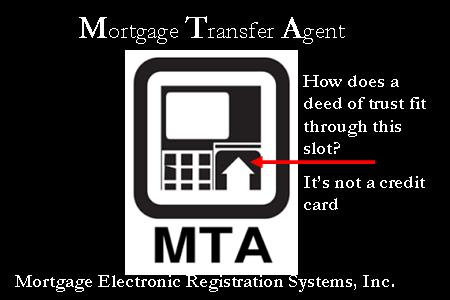

Section § 51.0001(4)(C) Texas Property Code creates "standing" to allow an unknown party to claim a deed of trust. Is this not criminal?

Picture this;

Restricting the Freedom of Contract: A Fundamental Prohibition

$5 minimum deposit online casino

$5 minimum deposit online casino

"An act which violates the Constitution has no power and can, of course, neither build up or tear down. It can neither create new rights nor destroy existing ones. It is an empty legislative declaration without force or vitality." - Carr v. State, (1890) 127 Ind. 204, 26 N. E. 778; 11 L. R. A. 370

"All persons are presumed to know the law, and if they act under an unconstitutional enactment of the legislature, they do so at their own peril, and must take the consequences." - Sumner v. Beeler, 50 Ind. 341 - 1875

$5 minimum deposit online casino

Em 23 de novembro, uma ação movida pelo blogue "Facebook Mirror" foi movida judicialmente pelo Facebook, alegando que a empresa tem um mecanismo de proteção contra invasões mal sucedidas.O "Facebook O "Facebook Mirror" foi fundado$5 minimum deposit online casino2013 por Arami Seedda, Jamal Al-Hussein e Hilary Seedda e anteriormente pelos usuários do Twitter, Mark Zuckerberg e Sebastian Bach.That's just the way it is...

This website is not for the lazy. If you can't find something because you are too lazy to look through this site, go away...... You don't need to find it.

If you are looking for something specific, email me. And stop whining because you are too lazy to look for something......

$5 minimum deposit online casino

"On October 28, 2005, [Viola] executed and delivered a mortgage upon real property [Viola] owned in Philadelphia, Pennsylvania to Mortgage Electronic Registration Systems , Inc. [(‘MERS’)], as nominee for American Mortgage Network, Inc. ([‘Amnet’).]"

Judge the Judge?

It does make you want to puke when you hear this from a court? The illegal security instruments are "form" contracts whch were created to disadvantage the "grantor". These instruments are created to impair the contract obligation by allowing "mystery" actors to partake in criminal activity. The "form" contract allows for tangibles to be converted to intangibles with the full force of law. Judges cannot honestly be that stupid not to be able to interpret what the private registry is? And they interpret law?

Yes, the above referenced case is another state but you can hear the parrot churping all across the country. Its in our court of appeals opinion. So, in Texas, this "nominee" statement makes it a bit clearer how the trustee was removed from the deed of trust by the borroweer agreeing to allow MERS as "nominee"? In Texas, the "grantor" signs [delivers the executed] mortgage to the trustee named within the deed of trust for a benefit of the lender. Changing "lien theory" to "title theory", while devastating past real property case law, and converting real property to personal property. In essence, "rights" were created to a disadvantage for the tangible "borrower".

Trust me

You see, there are two "trusts" if you will. In order to have an investment "Trust", you would need an asset such as a deed of trust, which we'll call trust #1. Trust #1 is registerd and pooled together with other trust #1's. Once the gathered trust #1's are pooled, they are placed in Trust #2, a securities trust. Trust #2 is sold, the mortgage loans are sold, non-recourse, with the servicing rights released. This is why you get a change of "mortgage servicer" in the mail. They just didn't tell you they were a "servicer" of a trust, and you assumed they meant your deed of trust?

The purchaser of the trust #2 will either become the "servicer", or contract out the "servicing" of trust #2. Nonetheless, you will get the "notice" as promised. I suppose this is where things get all screwed up and everybody gets lost in the "assignment", or the "appointment of substitute trustee"? It does get confusing, but it all boils down to the "form" security instrument called a deed of trust that is actually allows for illegal activity. Combine that with Texas Property code, and the actors can get away with it all day long because the judges apparently do not know how to interpret section § 51.0001. Surely they are not that stupid? Understand, it is a law that allows crimes to be comitted via "free pass" from the Texas property code? Did we mention constitutional violations?

$5 minimum deposit online casino

Even though "Right to Trial by Jury" is in the Bill of Rights, it makes one wonder how a judge upholds his oath "to God" to protect, preserve, and defend the Constitution?

IN THE NAME AND BY THE

AUTHORITY OF THE STATE OF TEXAS,

I,____________ , do solemnly swear (or affirm), that I will faithfully

execute the duties of the office of of the State of Texas, and will to

the best of my ability preserve, protect, and defend the Constitution

and laws of the United States and of this State, so help me God.

With that in mind, why does the judge violate his/her oath and ignore Article 5, section 10, part of which the judge swore to "preserve, protect, and defend"?

$5 minimum deposit online casino

Sec. 10. TRIAL BY JURY. In the trial of all causes in the District Courts, the plaintiff or defendant shall, upon application made in open court, have the right of trial by jury; but no jury shall be empaneled in any civil case unless demanded by a party to the case, and a jury fee be paid by the party demanding a jury, for such sum, and with such exceptions as may be prescribed by the Legislature.

Would this denial of trial by jury by a judge violate the constiution twice? One count in Bill of Rights, one count in Aricle 5, section 10? Would it violate the U.S. Constitution? So many things to ponder when looking into the hearts of men?

It is all about rights......... If you ignore the Constitution, you are violating the rights of many. If you ignore the Constitution to commit crimes, you are now holding prisoners against their will as you cannot commit crimes while punishing others for crime comitted like yours, and you hold a "free pass"? The Law may allow, but your consequences are unknown.

$5 minimum deposit online casino

This Court is deeply troubled that, with little to no oversight, individuals without any tie to or knowledge of the company on whose behalf they are acting may assign mortgages — that is, they may transfer legal title to someone else's home. Cf. Jenifer B. McKim, Building an Empire, One Home at a Time, Bos. Globe, Aug. 7, 2011. Equally troubling is the conflict of interest posed by these certifying officers wearing "two hats" simultaneously: that of assignor (as agent for MERS) and assignee (as employee of the note holder or its servicing agent). See James v. Recontrust Co., No. CV-11-CV-324-ST, 2011 WL 3841558, at *12 (D.Or. Aug. 26, 2011). Indeed, a MERS certifying officer is more akin to an Admiral in the Georgia navy or a Kentucky Colonel with benefits than he is to any genuine financial officer. In its rush to cash in on the sale of mortgage-backed securities, the MERS system supplies the thinnest possible veneer of formality and legality to the wholesale marketing of home mortgages to large institutional investors."

[More?] - In re Carrsow-Franklin, 524 BR 33 - Bankr. Court, SD New York 2015 [$5 minimum deposit online casino added] [emphasis added]

"As discussed in note 7 above, within the last few years several Texas courts have accepted the general proposition that MERS had the power to transfer interests in mortgages and deeds of trust, at least where, as was not the case here, the original deed of trust named MERS and specifically conferred on it the power to sell the collateral and transfer interests therein in the name not only of its nominee but also to its own successors in interest. What these courts do not address, perhaps because the issue was not raised, is that the authorized signing "officers" of MERS, if Mr. Kennerty is a typical example, never actually worked for that company, never had an agreement with that company, never received a paycheck from that company and were, in reality, really officers and employees of the lenders who were MERS members, Dep. Tr. at 99-102, and, therefore, that $5 minimum deposit online casino. That is, under the guise of being a MERS officer, an employee of Bank X could purport to transfer a mortgage held by MERS as nominee for Bank Y without Bank Y knowing about it or authorizing it with the exception of the fact that MERS had conferred signing authority on employees of its members, including employees of Bank X. See Culhane v. Aurora Loan Servs. of Nebraska, 826 F.Supp.2d 352, 374 (D.Mass.2011), decision reached on appeal, 708 F.3d 282 (1st Cir.2013) ("Equally troubling is the conflict of interest posed by these certifying officers wearing `two hats' simultaneously: that of assignor (as agent for MERS) and assignee (as employee of the note holder or its servicing agent).")"

If you read the Carrsow-Franklin opinion, in footnote 7, Nueces County v. MERS is noted, as the judge in that case recognized seemingly free acts of fraud.

$5 minimum deposit online casino

I've stated it before, and I'll state it again. The private registry parties are similar to "account debtors" and "creditors" defined in the Uniform Commercial Code. If you feel this to be in error, look at Texas UETA, chapter 322, section 016, subsection (e), of the Texas Business and Commerce Code. 322.016(e) states;

(e) Except as otherwise agreed, an obligor under a transferable record has the same rights and defenses as an equivalent obligor under equivalent records or writings under the Uniform Commercial Code.

Do you think Texas UETA is defining an obligor to a real property mortgage loan? The UCC does not apply to real property transactions. Oh, and you will find this certain wording within 15 USC 7021(e)

Oh, and why does E-SIGN not provide idenity to who the "issuer" is for an Authoritative Copy?

Was the "Note" even "negotiable"

"Rights"

"Snake-Oil Salesman" - Tommy Bastian at it again.......

$5 minimum deposit online casino

$5 minimum deposit online casino

$5 minimum deposit online casino

$5 minimum deposit online casino

$5 minimum deposit online casino

Why is it so difficult to obtain justice through the court system against a private registry that $5 minimum deposit online casinoutilated $5 minimum deposit online casinovery $5 minimum deposit online casinoecordation $5 minimum deposit online casinotatute in Texas? Here is why. Texas courts purportedly follow the enacted laws of the Texas Legislature. So who keeps the Texas Legislature, and its enactments in check with the rights guaranteed by the Texas Constitution? The Texas Constitution shows the way; Look at Article 3, section 43(b)

Sec. 43. REVISION OF LAWS. (a)

The Legislature shall provide for revising, digesting and publishing the

laws, civil and criminal; provided, that in the adoption of and giving

effect to any such digest or revision, the Legislature shall not be

limited by sections 35 and 36 of this Article.

(b) In this section, "revision" includes a

revision of the statutes on a particular subject and any enactment

having the purpose, declared in the enactment, of codifying without

substantive change statutes that individually relate to different

subjects.

(Subsec. (a) amended and (b) added Nov. 4, 1986.)

Did the Texas Legislature overlook section 35(b)?

Sec. 35. SUBJECTS AND TITLES OF

BILLS. (a) No bill, (except general appropriation bills, which may

embrace the various subjects and accounts, for and on account of which

moneys are appropriated) shall contain more than one subject.

(b) The rules of procedure of

each house shall require that the subject of each

bill be expressed in its title in a manner that gives the

legislature and the public reasonable notice of that subject. The

legislature is solely responsible for determining compliance with the

rule.

(c) A law, including a law enacted before the effective date of this

subsection, may not be held void on the basis of an insufficient title.

(Subsec. (a) amended and (b) and (c) added Nov. 4, 1986.)

As the future [now] has revealed the past [then], the "subject" was not really about whom could initiate foreclosure, the subject of chapter 51 is about a private registry used for private transactions between an account debtor and a creditor, conducting transactions electronically. An alleged "holder of a security instrument", and not an alleged holder of a debt as the statute once provided prior to the amendment in 2004, yet still "holder of the debt" is evident in certain parts of chapter 51 purportedly enacted prior to 2004 and cited as such; "Added by Acts 1995, 74th Leg., ch. 1020, Sec. 1, eff. Aug. 28, 1995"

$5 minimum deposit online casino

Even during an emergency, the Bill of Rights, in the Constitution of Texas rules as so stated in section 62. Why was it so constructively impaired prior to any emergency?

Provided, however, that Article I of the Constitution of Texas, known as the "Bill of Rights" shall not be in any manner affected, amended, impaired, suspended, repealed or suspended hereby.

Many subsections of Article 3, Section 56 come into question with the currently enacted chapter 51 of Texas Property Code.

$5 minimum deposit online casino

As

far back as 1840,

On September 1, 2004 elected officials allowed grave

errors to be placed into chapter 51 of the Texas Property code, that

would become superior to long established recordation statutes within

the Texas Local Government Code.

The current foreign entity being

alluded to as a "book entry system" cannot prove it meets the definition

within state or federal definitions of "national book entry system". To

do so, state law would preempt federal law, which would usurp federal

law, which would usurp securities law.

Chapter 51 provides for a definition of "book entry

system" which allows a non-defined private registry to use the Texas

Property code for the benefit of a non-defined private registry, or its

members. The private registry cannot be defined as a "national book

entry system", that definition is held for securities transactions

regulated by the Federal Reserve, Securities & Exchange Commission, or

other federally related securities agency regulations.

Chapter 51 allows an open

opportunity for the private registry to record instruments of an unknown

chain of title to many deed of trust in

Chapter 51 does not allow the

requirements of chapter 192.007(a) of the Texas Local Government code to

be fulfilled according to long established local statutory law. Allowing

such private registry to replace the

Chapter 51 allows for unknown parties of a private

registry to enforce a deed of trust without the need of the promissory

note the deed of trust was supposed to be attached to achieve the

secured creditor status of the indebtedness as once noticed

constructively in public records at origination of its recordation. This

can be observed within section 51.0001, subsections (1) through (8).

Chapter 51 allows for a private registry to be

called a “beneficiary”, “nominee”, “mortgagee” in a deed of trust, while

The undersigned financial institution organizations are writing to you

to urge that electronic negotiable instruments be included within the

scope of the National Conference of Commissioners on Uniform State Laws

(NCCUSL) current effort to revise UCC Articles3 and 4. We believe this

UCC Article3 and 4 revision project represents a unique and critical

opportunity for NCCUSL to provide leadership to the states and the

financial institution community on the timely and important issue of

electronic negotiable instruments.

Read it yourself

UNIFORM ELECTRONIC TRANSACTIONS ACT (1999)

Drafted by the NATIONAL CONFERENCE OF COMMISSIONERS ON UNIFORM STATE LAWS

and by it APPROVED AND RECOMMENDED FOR ENACTMENT IN ALL THE STATES

at its ANNUAL CONFERENCE MEETING IN ITS ONE-HUNDRED-AND-EIGHTH YEAR IN DENVER, COLORADO JULY 23 – 30, 1999

WITH PREFATORY NOTE AND COMMENTSSee Legislative Note below – Following Comments.

Comment [Emphasis added]

1. The scope of this Act is inherently limited by the fact that it only applies to transactions related to business, commercial (including consumer) and governmental matters. Consequently, transactions with no relation to business, commercial or governmental transactions would not be subject to this Act. Unilaterally generated electronic records and signatures which are not part of a transaction also are not covered by this Act. See Section 2, Comment 12.

2. This Act affects the medium in which information, records and signatures may be presented and retained under current legal requirements. While this Act covers all electronic records and signatures which are used in a business, commercial (including consumer) or governmental transaction, the operative provisions of the Act relate to requirements for writings and signatures under other laws. Accordingly, the exclusions in subsection (b) focus on those legal rules imposing certain writing and signature requirements which will not be affected by this Act.

3. The exclusions listed in subsection (b) provide clarity and certainty regarding the laws which are and are not affected by this Act. This section provides that transactions subject to specific laws are unaffected by this Act and leaves the balance subject to this Act.

4. Paragraph (1) excludes wills, codicils and testamentary trusts. This exclusion is largely salutary given the unilateral context in which such records are generally created and the unlikely use of such records in a transaction as defined in this Act (i.e., actions taken by two or more persons in the context of business, commercial or governmental affairs). Paragraph (2) excludes all of the Uniform Commercial Code other than UCC Sections 1-107 and 1-206, and Articles 2 and 2A. $5 minimum deposit online casino The Act does apply to UCC Articles 2 and 2A and to UCC Sections 1-107 and 1-206.

5. Articles 3, 4 and 4A of the UCC impact payment systems and $5 minimum deposit online casino. The check collection and electronic fund transfer systems governed by Articles 3, 4 and 4A involve systems and relationships involving numerous parties beyond the parties to the underlying contract. The impact of validating electronic media in such systems involves considerations beyond the scope of this Act. $5 minimum deposit online casinobecause the revision process relating to those Articles included significant consideration of electronic practices. $5 minimum deposit online casino because the drafting process of that Act also included significant consideration of electronic contracting provisions.

6. $5 minimum deposit online casino $5 minimum deposit online casino will not affect the Act’s coverage of Transferable Records. Section 16 is designed to allow for the development of systems which will provide “control” as defined in Section 16. Such control is necessary as a substitute for the idea of possession which undergirds negotiable instrument law. The technology has yet to be developed which will allow for the possession of a unique electronic token embodying the rights associated with a negotiable promissory note. Section 16’s concept of control is intended as a substitute for possession. The provisions in Section 16 operate as free standing rules, establishing the rights of parties using Transferable Records under this Act. The references in Section 16 to UCC Sections 3-302, 7-501, and 9-308 (R9-330(d)) are designed to incorporate the substance of those provisions into this Act for the limited purposes noted in Section 16(c). $5 minimum deposit online casino but would be an electronic record used for purposes of a transaction governed by Section 16. However, it is important to remember that those UCC Articles will still apply to the transferable record in their own right. $5 minimum deposit online casino See Comments to Section 16.

7. This Act does apply, in toto, to transactions under unrevised Articles 2 and 2A. There is every reason to validate electronic contracting in these situations.

$5 minimum deposit online casino[emphasis added]

"This litigation concerns the MERS system, an electronic mortgage registration system and clearinghouse that tracks beneficial ownership interests in, and servicing rights to, mortgage loans."- See IN RE MORTGAGE ELECTRONIC REGIST. SYSTEMS (MERS), 659 F. Supp. 2d 1368 - Judicial Panel on Multidistrict Litigation.

So, where is the definiion of "clearinghouse"? You can find it in 4a, Texas Business and Commerce Code; § 4.104(4)

(4) "Clearing house" means an association of banks or other payors regularly clearing items.

$5 minimum deposit online casino

5. Articles 3, 4 and 4A of the UCC impact payment systems and $5 minimum deposit online casino. The check collection and electronic fund transfer systems governed by Articles 3, 4 and 4A involve systems and relationships involving numerous parties beyond the parties to the underlying contract. See UNIFORM ELECTRONIC TRANSACTIONS ACT (1999)

Do you see the "rabid cow" yet?

$5 minimum deposit online casino

Off the wall?

Let's say the Texas Legislaure was thinking about NMLS when it vaguely described a "book entry system"? Does the NLMS look or work like the clearinghouse? Oh, and is the clearinghouse recognized as being licensed to participate in NLMS? Do your own search?

NMLS is the system of record for non-depository, financial services licensing or registration in participating state agencies, including the District of Columbia and U.S. Territories of Puerto Rico, the U.S. Virgin Islands, and Guam. In these jurisdictions, NMLS is the official system for companies and individuals seeking to apply for, amend, renew and surrender license authorities managed through NMLS by 61 state or territorial governmental agencies. NMLS itself does not grant or deny license authority

Virtual Underwriter - Power of Attorney

Excerpt; [emphasis added]

Durable - discussed later in Section 15.48.6

Requirements

For title insurance

purposes, a power of attorney authorizing an agent to act for a

principal in matters concerning real property must

be in writing, acknowledged, and recorded in the office of the county

recorder of the county in which the real property is situated.

RESPA - Know your rights, know their rights....

DOJ - Deprivation Of Rights Under Color Of Law

$5 minimum deposit online casino A Remedy for the Violation of Constitutional Rights

[more to come...]

Namaste,